Tag Archives: Hospitality Industry

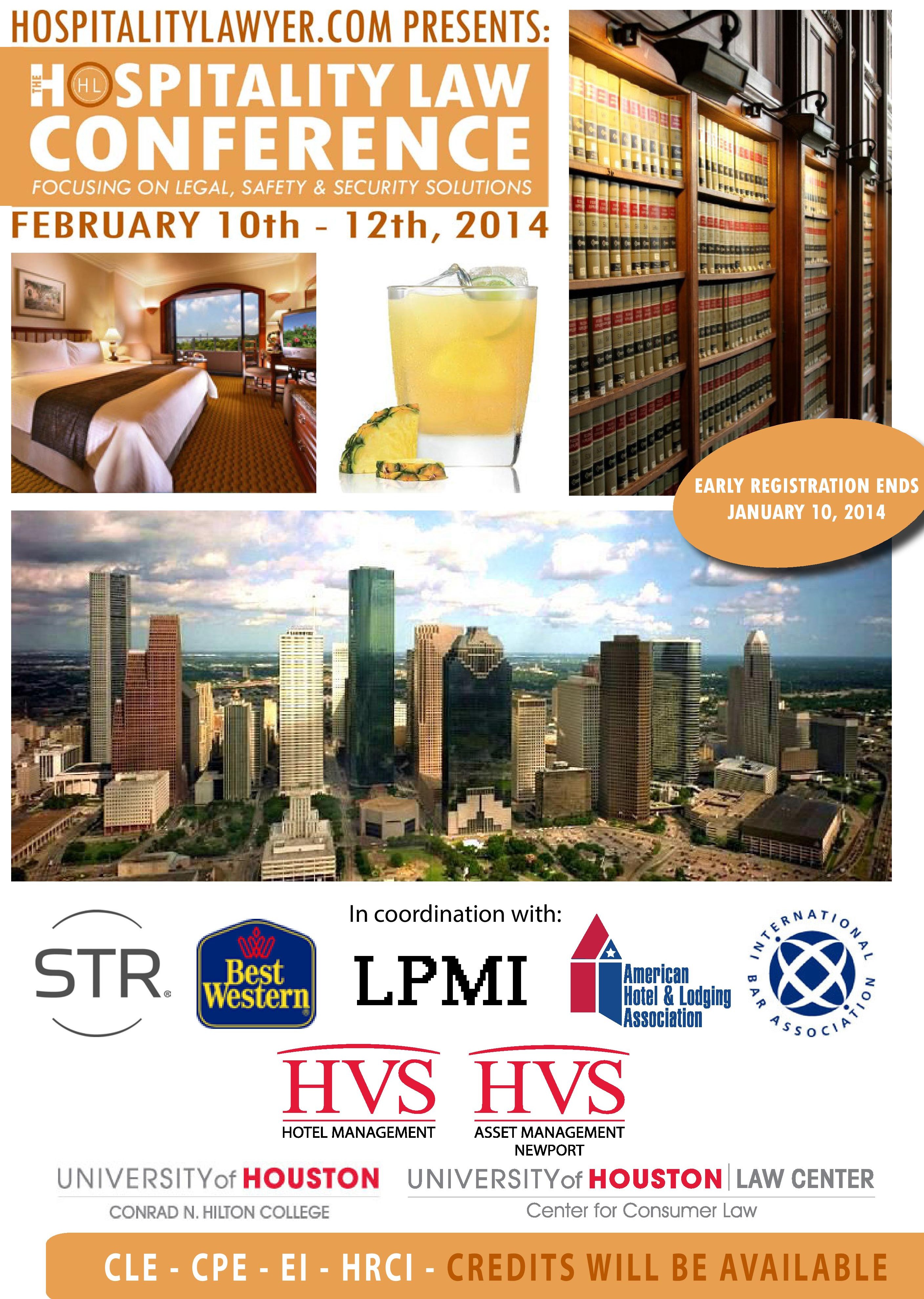

“2014 Hospitality Law Conference” Sponsored By HospitalityLawyer.com On February 10-12 Features Industry Legal, Safety And Security Solutions

Comments Off on “2014 Hospitality Law Conference” Sponsored By HospitalityLawyer.com On February 10-12 Features Industry Legal, Safety And Security Solutions

Filed under Conferences, Guest Issues, Injuries, Insurance, Labor Issues, Liability, Management And Ownership, Risk Management, Training

P3 Hospitality Industry Risk Report: “Hospitality Hoaxes And Scams†By Petra Risk Solutions’ Director Of Risk Management Todd Seiders, CLSD

[vimeo http://vimeo.com/52048409]

![]() Petra Risk Solutions’ Director Of Risk Management, Todd Seiders, CLSD , offers a P3 Hospitality Risk Update – ‘Hospitality Hoaxes And Scams’.

Petra Risk Solutions’ Director Of Risk Management, Todd Seiders, CLSD , offers a P3 Hospitality Risk Update – ‘Hospitality Hoaxes And Scams’.

P3 (Petra Plus Process) is the Risk Management Division of Petra Risk Solutions – America’s largest independent insurance brokerage devoted exclusively to the hospitality marketplace.

For more information on Petra and P3 visit petrarisksolutions.com or call 800.466.8951.

Comments Off on P3 Hospitality Industry Risk Report: “Hospitality Hoaxes And Scams†By Petra Risk Solutions’ Director Of Risk Management Todd Seiders, CLSD

Filed under Guest Issues, Injuries, Labor Issues, Liability, Management And Ownership, Risk Management, Training

P3 Hospitality Industry Risk Report: “Hospitality Hoaxes And Scams†By Petra Risk Solutions’ Director Of Risk Management Todd Seiders, CLSD

[vimeo http://vimeo.com/52048409]

![]() Petra Risk Solutions’ Director Of Risk Management, Todd Seiders, CLSD , offers a P3 Hospitality Risk Update – ‘Hospitality Hoaxes And Scams’.

Petra Risk Solutions’ Director Of Risk Management, Todd Seiders, CLSD , offers a P3 Hospitality Risk Update – ‘Hospitality Hoaxes And Scams’.

P3 (Petra Plus Process) is the Risk Management Division of Petra Risk Solutions – America’s largest independent insurance brokerage devoted exclusively to the hospitality marketplace.

For more information on Petra and P3 visit petrarisksolutions.com or call 800.466.8951.

Comments Off on P3 Hospitality Industry Risk Report: “Hospitality Hoaxes And Scams†By Petra Risk Solutions’ Director Of Risk Management Todd Seiders, CLSD

Filed under Guest Issues, Injuries, Labor Issues, Liability, Management And Ownership, Risk Management, Training

Hospitality Industry Payment Risks: Hotel Tech Trade Association Releases “Secure Payments Framework For Hospitality”; Best Practices Advocates “Tokenization” And “Removal Of All Guest Credit Card Data From Systems”

For more:Â http://www.scmagazine.com/hotel-tech-trade-association-offers-best-practices-for-reducing-payment-card-risk/article/283129/

Comments Off on Hospitality Industry Payment Risks: Hotel Tech Trade Association Releases “Secure Payments Framework For Hospitality”; Best Practices Advocates “Tokenization” And “Removal Of All Guest Credit Card Data From Systems”

Filed under Crime, Guest Issues, Insurance, Labor Issues, Liability, Management And Ownership, Risk Management, Technology, Theft

Hospitality Industry Insurance Risks: Pending Legislation Before Congress Deals With Medicare Payments, Workers' Compensation And Liability Insurance Claims

“…the Medicare Secondary Payer and Workers’ Compensation Settlement Agreements Act of 2012…deals only with workers’ compensation claims, and seeks to establish clear and consistent rules for workers’  compensation set-asides for claimants covered by Medicare…”

compensation set-asides for claimants covered by Medicare…”

“…The Strengthening Medicare and Repaying Taxpayers Act…deals with issues related to the Medicare Secondary Payment Act. Specifically, it deals with mandates for providing timely information on conditional payments, penalties and statutes of limitations when claims are reported to the Centers for Medicare and Medicaid Services by insurers and self-insured and third-party payers on no-fault auto-insurance claims, workers’ compensation claims, and claims under liability insurance…”

Insurance and related industries are seeking to win support in the waning days of the current Congress for two pieces of legislation dealing with payment of injured worker claims to people whose primary insurance is Medicare. Officials of both the American Insurance Association and the Property Casualty Insurers Association of America are urging action on the bills this year.

Nathaniel Wienecke, PCI senior vice president, Wednesday asked officials of the Senate Finance Committee and the House Ways and Means Committee if it could act on the bill this year.

Currently, workers’ compensation claims that overlap with Medicare coverage are subject to lengthy, cumbersome review by the Centers for Medicare and Medicaid Services to establish the proper “set-side†coverage amounts for future medical expenses, according to PCI officials.

For more:Â http://www.propertycasualty360.com/2012/12/14/insurance-reps-push-for-action-on-medicare-seconda?t=commercial

Comments Off on Hospitality Industry Insurance Risks: Pending Legislation Before Congress Deals With Medicare Payments, Workers' Compensation And Liability Insurance Claims

Filed under Claims, Health, Injuries, Insurance, Labor Issues, Legislation, Management And Ownership

Hospitality Industry Business Risks: Hotel Owners Must Consider "Business Loss/Interruption Insurance" As Part Of Comprehensive "Disaster Insurance" Coverage

“…many hotels don’t have business interruption insurance because it comes with higher premiums and deductibles…(one hotel) close to the Kentucky Derby area was hit by a tornado…the hotel wasn’t damaged, but they lost all of their utilities. If they hadn’t had that business loss insurance, they would have lost all of that income they  would have generated during the race.â€

would have generated during the race.â€

After two tornadoes hit the same Midwest region in the United States within a year and caused extensive hotel damage, disaster insurance deductibles are on the rise and hoteliers are mulling their coverage options.

- Higher deductibles – While premiums appear to be remaining steady, insurance companies in the Midwest are charging a higher rate of percentage deductibles to help keep costs down, he said. As an example, if a hotel had $100 million in coverage and there was a 5% deductible, the deductible would be $5 million.

- Wind and flood insurance premiums in the Midwest remain relatively flat overall, with slight increases for some hotels. In other parts of the country, such as coastal areas, the cost of wind and flood insurance has risen 8% to 10% on average, according to sources.

- Reinsurance options—insurance that is purchased by one insurance company from another—are available, as are percentage deductibles based on the amount of coverage rather than a flat rate.

- Wind deductible buy-back insurance—which provides a buy-back policy that reduces the higher percentage deductible—with deductibles most likely still will be higher than the flat deductibles previously offered.

- Storm surge coverage is available under a flood plan or wind storm plan. Some policies exclude floods altogether.

- Business loss/interruption insurance -Â Hotels impacted after the 9/11 terrorist attacks and hotels in California affected by the 1994 Northridge, California, earthquake would have benefited greatly from business loss/interruption insurance.

For more:Â http://www.hotelnewsnow.com/Articles.aspx/8282/Hoteliers-mull-disaster-insurance-options

Filed under Claims, Insurance, Liability, Maintenance, Management And Ownership, Risk Management

P3 Hospitality Industry Risk Report: "Sales/Group Contracts" Discussed By Todd Seiders, Director Of Risk Management For Petra Risk Solutions (Video)

[youtube=http://www.youtube.com/watch?v=9r_sKI3wIPg&feature=email]

Petra Risk Solutions’ Director of Risk Management, Todd Seiders, offers a P3 Hospitality Risk Report – ‘Sales/Group Contracts’.Â

Petra Risk Solutions’ Director of Risk Management, Todd Seiders, offers a P3 Hospitality Risk Report – ‘Sales/Group Contracts’.Â

P3 ( Petra Plus Process) is the Risk Management Division of Petra Risk Solutions – America ’s largest independent insurance brokerage devoted exclusively to the hospitality marketplace.

For more information on Petra and P3 visit petrarisksolutions.com or call 800.466.8951.

Comments Off on P3 Hospitality Industry Risk Report: "Sales/Group Contracts" Discussed By Todd Seiders, Director Of Risk Management For Petra Risk Solutions (Video)

Filed under Claims, Insurance, Management And Ownership, Risk Management, Training

Hospitality Industry Health Risks: "Bed Bug Summit" Being Held In Washington DC Focuses On Need To Develop And EPA To "Approve" Effective Commercial Pesticides

Hotel operators, public-health officials and leaders of an industry spawned to combat bedbugs urged tighter U.S. regulations and development of effective pesticides during the second National Bed Bug Summit.

“Given the difficulty of exterminating bedbugs, we are calling upon†the EPA “to conduct further research and development of effective pesticides,†Council Speaker Christine Quinn wrote in a Jan. 31 letter to the EPA with fellow members.

“Given the difficulty of exterminating bedbugs, we are calling upon†the EPA “to conduct further research and development of effective pesticides,†Council Speaker Christine Quinn wrote in a Jan. 31 letter to the EPA with fellow members.

Â

Â

- The Environmental Protection Agency convened the meeting as New York City Council members urged the agency to set regulations for better use of insecticides.

- There are over 300 pesticide products registered to get rid of bed bugs, according to the Office of Pesticide Programs at the Environmental Protection Agency

- Research shows that bed bugs may be developing resistance to some pesticides.

“It remains a huge concern,†said Joseph McInerny, chief executive officer of the American Hotel and Lodging Association at the two-day conference in Washington that ends today. Housekeeping and maintenance staff are the “first line of defense,†spotting speckles of blood that signal rooms may be closed for weeks by an infestation, he said yesterday.

Bedbugs — wingless insects that feed on the blood of sleeping animals — invaded stores of Abercrombie & Fitch Co., Victoria’s Secret and Nike Inc.’s Niketown in New York City last year as well as hotels, offices and homes.

The insects can cause reactions through bites, as well as blister-like skin infections and, in rare cases, asthma and anaphylactic shock, according to a report in the Journal of the American Medical Association.

“2010 was definitely the year of the bedbug,†Natalie Raben, marketing director of M&M Environmental, a New York pest- management company said at the conference.

Comments Off on Hospitality Industry Health Risks: "Bed Bug Summit" Being Held In Washington DC Focuses On Need To Develop And EPA To "Approve" Effective Commercial Pesticides

Filed under Guest Issues, Health, Liability, Management And Ownership, Risk Management

Hospitality Industry Health Care: Smaller Hotel Owners Will Struggle With “Medical Loss Ratio” And Must Find Hospitality Industry Health Care Insurance Specialist

The Affordable Care Act sets a minimum threshold for what’s known as the “medical loss ratio” — the percentage of premium dollars that go into medical care (a “loss” from Wall Street’s view) rather than into overhead or profits. For plans sold to small businesses or directly to individuals, that ratio must be at least 80 percent; for plans sold to large groups, it must be at least 85 percent.

For big insurance companies that sell predominantly to big employers, the medical loss ratio shouldn’t be hard to meet. With their economies of scale, these insurers and employers together provide coverage at relatively low administrative cost (although, it should be noted, Medicare’s overhead is even lower). But smaller insurers that deal primarily with individuals or small businesses will have a tougher time. Among other things, they typically lose 8 percent of premiums on commissions to agents and brokers who sell policies on their behalf. (Once the insurance exchanges exist, much of that cost will disappear.) These are also the insurers most likely to bilk consumers, since individuals buying coverage on their own typically lack the knowledge — or ability — to bargain as shrewdly as corporate benefits managers do. (The exchanges should also help with improved information and bargaining leverage.)

There’s leeway in the rule in two key places. The law doesn’t dictate a precise formula for calculating the medical-loss ratio. It’s up to the administration which “care management” activities count as medical care, whether taxes should be part of the calculation, and the extent to which carriers can average out the ratio among different plans. And while the law calls for the requirement to take effect starting in January 2011, the Department of Health and Human Services has the authority to phase it in; Sebelius could, for instance, set the floor at 70 percent for 2011 and then gradually ratchet it up until 2014. Some insurance and employer lobbyists have urged the administration to move slowly, lest insurers unable to meet those requirements go out of business. Then again, insurers that can’t meet those requirements are, by definition, less efficient.

For more:Â Â http://www.tnr.com/blog/jonathan-cohn/77080/get-ready-sebelilus-v-insurers

Comments Off on Hospitality Industry Health Care: Smaller Hotel Owners Will Struggle With “Medical Loss Ratio” And Must Find Hospitality Industry Health Care Insurance Specialist

Filed under Health, Insurance, Risk Management